In recent times, the ‘Beyond Finance’ lawsuit has become a topic of concern, prompting individuals to seek clarity on the company’s practices. The lawsuit, which has garnered significant attention, revolves around allegations of misleading practices and deceptive advertising by Beyond Finance. Consumers are now eager to understand the implications of this legal battle and how it may impact their financial interactions with the company.

From beyond finance complaints to beyond finance reviews BBB, consumers are actively engaging with online platforms to gather information. These platforms serve as a hub for individuals to share their experiences and concerns regarding Beyond Finance. Whether through forums, review websites, or social media channels, consumers are voicing their opinions and seeking validation for their financial decisions.

Additionally, questions arise regarding the beyond finance cancellation policy. Consumers are interested in understanding the procedures and potential implications associated with canceling services or agreements with Beyond Finance. This aspect of the company’s operations is crucial for individuals considering alternatives or reassessing their financial commitments.

- Unveiling the Allegations: Beyond Finance Lawsuit Reddit

- Assessing Consumer Experiences: Beyond Finance Reviews BBB

- Understanding the Cancellation Policy: Beyond Finance Cancellation Policy Reviews

- Evaluating Worth: Is Beyond Finance Worth It Reddit?

- Exploring Revenue Streams: How Does Beyond Finance Make Money?

- Conclusion

Unveiling the Allegations: Beyond Finance Lawsuit Reddit

The ‘Beyond Finance’ lawsuit revolves around allegations of misleading practices and deceptive advertising. Consumers, as seen on platforms like Reddit, have voiced concerns about the company’s failure to deliver on promises of debt relief. Individuals share anecdotes and experiences, highlighting discrepancies between Beyond Finance‘s marketing claims and the actual outcomes experienced by consumers.

These discussions shed light on the challenges faced by individuals seeking financial stability. Many consumers express frustration and disappointment with Beyond Finance‘s services, citing unexpected fees, lack of transparency, and failure to provide meaningful debt relief. The lawsuit serves as a platform for these grievances to be addressed and potentially rectified.

Assessing Consumer Experiences: Beyond Finance Reviews BBB

One valuable resource for individuals considering enrolling in Beyond Finance programs is Beyond Finance reviews on platforms like the Better Business Bureau (BBB). These reviews offer insights into consumer experiences and provide valuable feedback for prospective clients. While some reviews may highlight the positive aspects of Beyond Finance‘s services, others may raise concerns about transparency, fees, and overall effectiveness.

Consumers rely on these reviews to make informed decisions about whether Beyond Finance is the right fit for their financial needs. By analyzing the experiences of past clients, individuals can gain a better understanding of what to expect from the company and whether it aligns with their expectations and goals.

Understanding the Cancellation Policy: Beyond Finance Cancellation Policy Reviews

An essential aspect of any financial service is its cancellation policy. Reviews detailing the beyond finance cancellation policy offer insights into the procedures and potential implications associated with discontinuing services or agreements with Beyond Finance. Consumers are keen to understand whether there are any fees, penalties, or restrictions associated with canceling their engagement with the company.

By reviewing these policies, individuals can make informed decisions about their financial commitments and assess the potential risks and consequences of canceling Beyond Finance services. This information empowers consumers to take control of their financial decisions and ensures they are fully aware of the terms and conditions governing their interactions with the company.

Evaluating Worth: Is Beyond Finance Worth It Reddit?

For many individuals, the question of whether Beyond Finance is worth it extends beyond financial considerations. Discussions on platforms like Reddit delve into the company’s efficacy, transparency, and overall impact on consumers’ financial well-being. Redditors share their personal experiences, anecdotes, and insights, providing valuable perspectives for individuals considering enrolling in Beyond Finance programs.

By exploring firsthand accounts and engaging with fellow Redditors, individuals can gain a deeper understanding of the value proposition offered by Beyond Finance. These discussions help individuals assess whether the benefits of Beyond Finance‘s services outweigh any potential drawbacks or concerns, ultimately guiding their decision-making process.

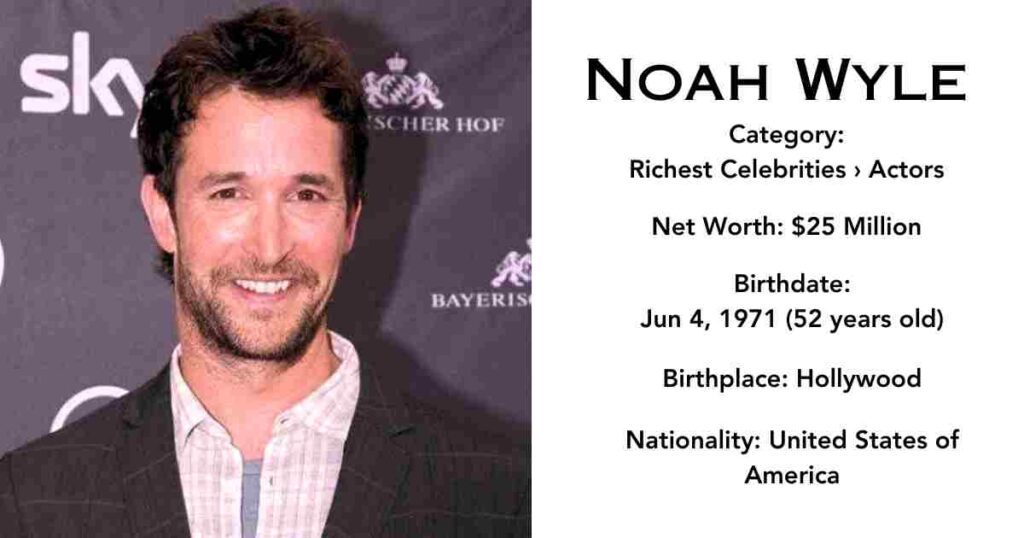

READ ALSO: Noah Wyle Net Worth: The Life and Earnings of a Hollywood Icon

Exploring Revenue Streams: How Does Beyond Finance Make Money?

A critical aspect of understanding any financial service provider is discerning its revenue streams. Delving into how Beyond Finance makes money offers insights into its business model, motivations, and potential conflicts of interest. Consumers are interested in understanding whether the company’s revenue generation aligns with its stated mission and values.

By exploring Beyond Finance‘s revenue streams, individuals can gain a better understanding of the company’s financial incentives and how they may impact its interactions with clients. This information enables consumers to make more informed decisions about whether to engage with Beyond Finance and trust the company with their financial needs.

Conclusion

In conclusion, the ‘Beyond Finance’ lawsuit serves as a catalyst for deeper scrutiny into the company’s practices and services. Through platforms like Reddit and the Better Business Bureau, consumers share their experiences, concerns, and insights, contributing to a broader discourse on transparency, efficacy, and consumer rights.

By leveraging resources such as Beyond Finance reviews BBB and insights into its cancellation policy, individuals can navigate the landscape of financial services with greater confidence and awareness. As the legal proceedings unfold, it’s imperative for consumers to remain informed and vigilant, advocating for their rights and well-being in the realm of personal finance.

Kate shines as the authoritative voice behind Supreme Hall’s ‘Business’ category. With her sharp business acumen and expert analysis, she delivers compelling content on entrepreneurship, marketing strategies, and industry insights, guiding readers towards success in the dynamic world of business.